31+ Maximum you can borrow mortgage

But realize that the more you spend on housing the less youll have for other consumption items or vacations and the longer youll have to work until retirement. You can send us comments through IRSgovFormComments.

Tips For First Time Home Buyers Myhomeanswers

If you already have a Bounce Back Loan but borrowed less than you were entitled to you can top up your existing loan to your maximum amount.

. FEATURED A NEW CASHBACK OFFER. This increase in mortgage payments can influence how much people want to borrow. Capital and interest or interest only.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. The maximum amount that an employee or employer can contribute to a 401k.

Exclusions and TCs Apply. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. The maximum you can get is the amount of your first estimated payment.

With an interest only mortgage you are not actually paying off any of the loan. Factors that impact affordability. If you borrow money and use 70 of it for business and the other 30 for a family vacation you can generally deduct 70 of the interest as a business.

If youre claiming universal credit youll have to apply for an advance rather than a budgeting loan. In London the maximum you could borrow through the equity loan would be 240000 which is 40 of 600000. The named beneficiary receives the proceeds and is thereby safeguarded from the.

The amount you can borrow may differ. The reality is about half of all marriages end in divorce a shattering experience that forces partners to divide assets and debt. Available on new borrowings from 50000.

The house must also be bought from a builder recognized by the program. Second mortgages come in two main forms home equity loans and home equity lines of credit. Yes you can probably spend more than 20 without going broke.

And you can get a traditional mortgage there are pros and cons to this scheme. Many couples especially those with two incomes often have no choice but to sell their homes pay off their loans and split the remaining money. You can apply to borrow from 100 to 812 depending on your circumstances the urgency of your situation and funds available in your region.

The maximum depends on the value of your home what you can afford to repay and what you plan to do with the money. There are two different ways you can repay your mortgage. Credit provided by HSBC Bank Australia Limited ABN 48 006 434.

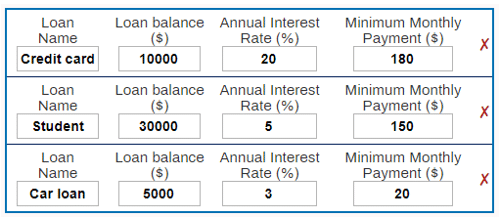

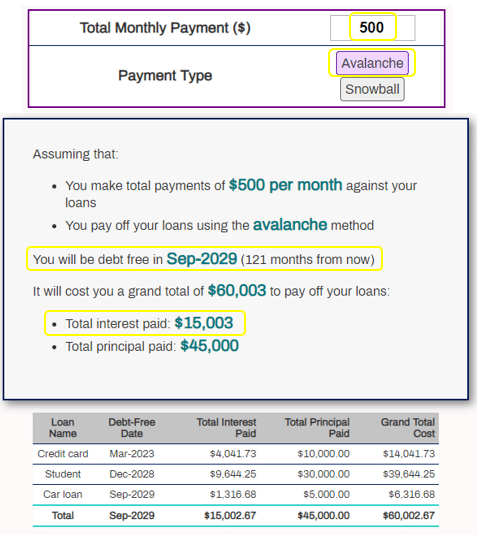

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Subtract your other debts including your car payment your student loan payment and other debt payments from this amount to determine the maximum amount you can spend on your monthly mortgage payment. The mortgage should be fully paid off by the end of the full mortgage term.

With an interest only mortgage you are not actually paying off any of the loan. With a capital and interest option you pay off the loan as well as the interest on it. Youll need to apply by Monday 31 October 2022.

Calculate how much you can borrow Calculate how much you can borrow View Home Loan Borrowing. Life insurance is a protection against financial loss that would result from the premature death of an insured. There are two different ways you can repay your mortgage.

The mortgage should be fully paid off by the end of the full mortgage term. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 31. The term payday in payday loan refers to when a borrower writes a postdated check to the lender for the payday salary but receives part of that payday sum in immediate cash from.

When it comes to calculating affordability your income debts and down payment are primary factors. 80 More details. Variable 0 799.

Multiply your annual salary by 036 percent then divide the total by 12. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Things can get really complicated especially when mortgage loans are involved.

Technically you cant take a loan from a traditional or Roth IRA but you can access money for a 60-day period through whats called a tax-free rollover as long as you put the money back into the. Most lenders ideally like to see a down payment of around 20 of the price of the homePutting 20 down on your home eliminates the need for private mortgage insurance PMI requirements though may lenders allow buyers to purchase their home with smaller down payments. 4 Reasons to Borrow From Your 401k 26.

For those with the choice. You can learn more about the standards we follow in producing accurate. You must request the top-up by 31 March 2021.

While your personal savings goals or spending habits can impact your. The loan is secured on the borrowers property through a process. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure.

Maximum loan amount is 15000000. NW IR-6526 Washington DC 20224. Mortgage repayments when you can to save yourself some interest over the life of.

The down payment also has an. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. Second mortgage types Lump sum.

Yes it probably isnt the end of the world if you get a 30-year mortgage instead of a 15-year. LVR subject to HSBCs assessment lending criteria and Lenders Mortgage Insurance LMI acceptance. A payday loan also called a payday advance salary loan payroll loan small dollar loan short term or cash advance loan is a short-term unsecured loan often characterized by high interest rates.

HomeReady is a conventional mortgage loan via Fannie Mae which means that you are required to pay private mortgage insurance until your homes loan-to-value LTV reaches 80 of the original. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan. The average homeowner puts about 10 down when they buy.

This is the maximum amount you can pay toward debts each month. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

With a capital and interest option you pay off the loan as well as the interest on it. Capital and interest or interest only. Choose a term of up to 35 years to a maximum 68 years of age Choose from competitive fixed or.

For example with the 225 basis point increase in the mortgage interest rate from average mortgage rates prior to May monthly payments on a new principal and interest 25-year loan will be around 25 per cent larger he said.

![]()

Refinance Student Loans 15 Minutes 3 Simple Steps

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

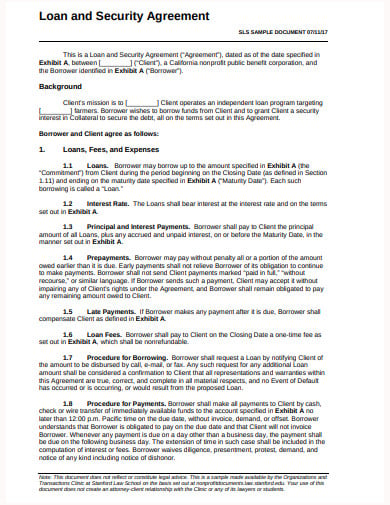

Free 10 Loan And Security Agreement Templates In Ms Word Pdf Free Premium Templates

![]()

Refinance Student Loans 15 Minutes 3 Simple Steps

Definition Time Today S Mortgage Vocab Is Annual Percentage Rate Apr In 2022 Mortgage Brokers Mortgage Tips The Borrowers

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Home Equity Loan Home Improvement Loans

New Patch Notes R Afkarena

Opting For A Home Loan From A Bank A Step Wise Guide By Nvt Quality Lifestyle Home Loans Loan Helpful

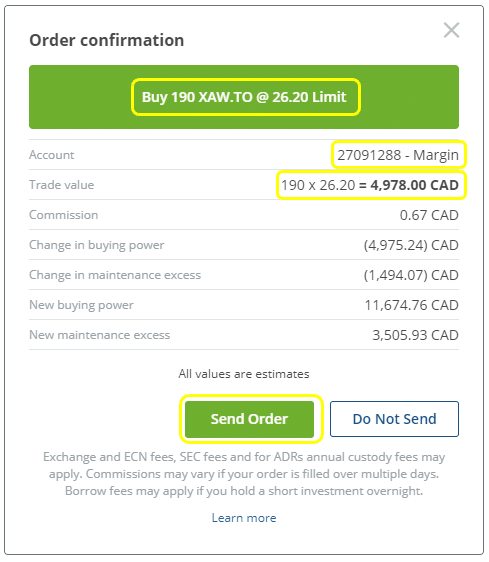

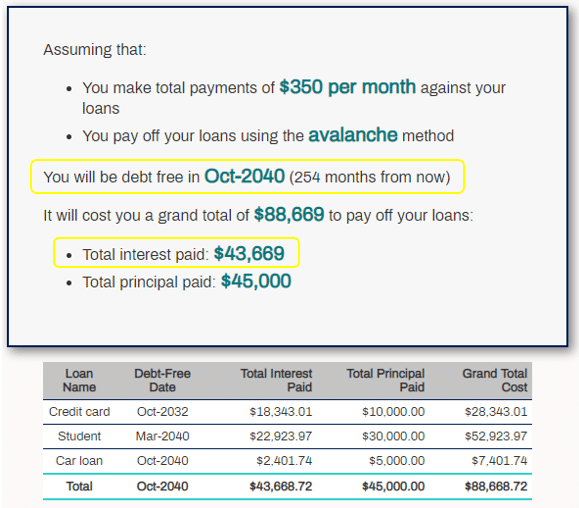

The Measure Of A Plan

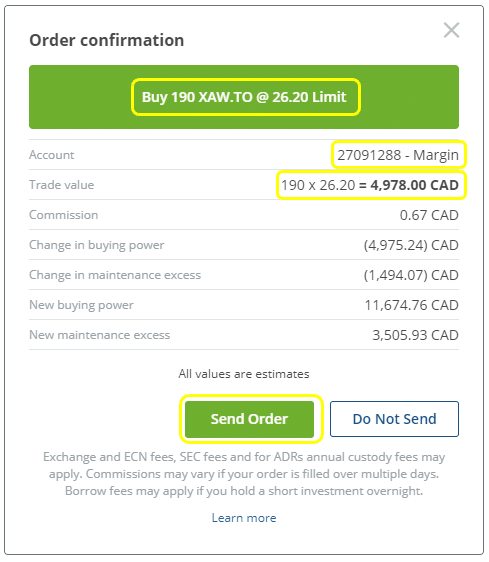

Pin On Data Vis

The Measure Of A Plan

The Measure Of A Plan

6 Loan Proposal Templates Pdf Word Free Premium Templates

Are Payday Loans Quick To Process Infographic Business Finance Payday Loans Payday Payday Loans Online

6 Things To Do For Quick Approval Of Personal Loan Personal Loans Person Financial Decisions

The Measure Of A Plan

Free 37 Loan Agreement Forms In Pdf Ms Word